- Laatste update: 10/03/2025

Italy has pioneered e-invoicing. Here you will find an overview of the main aspects of e-invoicing in Italy, including legislation, networks, formats and international invoicing.

Discover all the info about e-invoicing in Italy here.

E-invoicing legislation for Italian companies

What is the current state of e-invoicing in Italy?

- 2015: Requirement for B2G (business-to-government) transactions.

- Companies sending invoices to the government must send them through the Sistema di Interscambio (SDI).

- 2019: Requirement for B2B and B2C transactions.

- All businesses were required to send and receive e-invoices through the SDI from July 2019, with the exception of small businesses with low turnover.

- Exceptions:

- Small businesses with sales under €65,000 per year can continue to invoice in paper format for now, but the legislation is getting stricter.

Networks and formats

Sistema di Interscambio (SDI): The central platform of the Italian tax authority, through which all e-invoices must be sent.

FatturaPA: The standard XML format used by most Italian companies.

FatturaEU: The European format that complies with European standard EN 16931 and is suitable for cross-border e-invoicing.

Codice Univoco: For B2G invoices, a unique Codice Univoco is used to identify the recipient.

Codice Destinatario: For B2B invoices, a Codice Destinatario is used to identify the recipient.

International billing

Sending cross-border invoices:

Italian companies must also send e-invoices for foreign customers through the SDI.

Foreign recipients do not have access to the SDI, so the Italian sender must send a copy of the invoice by other means (e.g., EDI, PDF or mail).

Receiving cross-border invoices:

Italian companies that receive a foreign invoice must convert it to a FatturaPA “self-invoice” and send it to themselves through the SDI to register it as a tax document.

E-archiving

Mandatory digital archiving: Italian companies must digitally archive their invoices for 10 years. Invoices must be signed and stored in annual packages to ensure document integrity.

Conservation Manager: Companies must appoint a Conservation Manager who is responsible for adhering to archiving rules and managing digital archives.

E-reporting in Italy

E-Reporting is mandatory in Italy for VAT purposes:

- Companies must submit data on their invoices through the SDI, which acts as the platform for both e-invoicing and reporting.

- This helps the IRS check tax returns and prevent tax fraud.

As a Belgian company, how do I send an invoice to Italy?

If you are a Belgian company doing business with an Italian company, you do not have to comply with Italian legislation. With international invoicing, there are currently no specific guidelines yet. So at the moment you can still send emails or postal invoices.

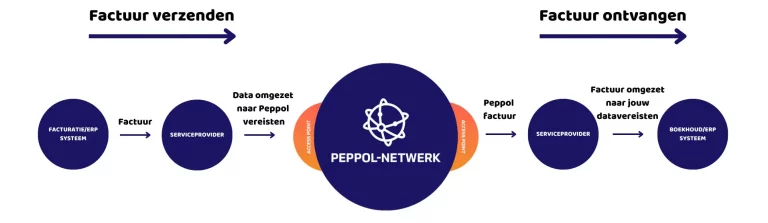

To send e-invoices within Belgium, you must register through a certified Peppol Access Point such as Nymus. Both sole traders and multinationals can use the Peppol network. The choice of a Peppol Access Point is not insignificant and strongly depends on your business needs. Do you opt for a Peppol button in your ERP or billing package, or do you opt for an e-service provider that completely unburdens you?

Why choose Peppol with Nymus?

When you choose Peppol with Nymus, we completely unburden you. We are not a standard Peppol Access Point but a total solution for your billing process. Our goal is to seamlessly integrate Peppol into your entire process.

Our clients don’t have to lie awake about their billing process because we have all the knowledge and resources to do it for you. These are the factors that set us apart from other solutions.

- We'll make sure you comply with all the rules without a lot of internal changes.

- We think with you to provide a solution to your current problems.

- We completely unburden you. You don't have to lie awake worrying about all the changes in technology, legislation and tax or financial obligations.

- Thanks to our innovative mindset, we are keeping up with AI and blockchain developments. As a result, our technology is on point.

- At Nymus, a personal approach is key. We can be reached quickly, are short on time and know our clients' organization.

Nymus is ready for you

Still have questions or need help? No worries, we have a strong support team. We will guide you through the transition and help where needed.

Send Peppol invoices to Italy flawlessly and efficiently? Contact us without obligation.

HIGHLIGHTED ARTICLES