- Laatste update: 18/10/2024

In Luxembourg, there are various requirements and obligations related to e-invoicing, both for transactions with the government (B2G) and for companies (B2B).

Discover below the current legislation and what options Luxembourg companies have to exchange e-invoices.

B2G e-invoicing in Luxembourg

Public authorities: Since March 18, 2023, all public institutions in Luxembourg must be able to receive and process e-invoices through the Peppol network (Peppol BIS v3 Billing).

Suppliers to the government: Suppliers are required to send structured e-invoices to the government through one of the following options:

- MyGuichet.lu portal: Here you can manually enter invoice dates or upload an XML e-invoice. This requires a Luxembourg identity card or a one-time code.

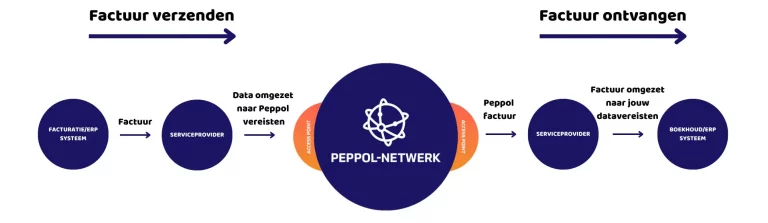

- Peppol: The Recommended Method. With a certified Peppol Access Point, you can quickly send invoices to government agencies. Peppol is accessible to businesses of all sizes, from sole proprietors to large corporations.

B2B e-invoicing in Luxembourg

No obligation: Currently there is no legal obligation for companies to send e-invoices to each other (B2B), but it is strongly recommended because of its efficiency, cost savings and security.

Benefits of e-invoicing: Electronic invoices are faster, more secure and cheaper than paper invoices. This makes it attractive for companies to switch, even if it is not yet mandatory.

Archiving

Digital archiving: Companies may archive their invoices digitally, provided the integrity, authenticity and legibility of the documents are guaranteed. The retention period for invoices in Luxembourg is 10 years.

Peppol in Luxembourg

Peppol as a standard: Luxembourg uses the Peppol network for sending e-invoices to governments. The government is connected to Peppol, and companies can easily send e-invoices through a Peppol Access Point.

Security and reliability: The Luxembourg government oversees the reliability and security of Peppol services through the Ministry of Digitalization, which serves as the Peppol Authority.

As a Belgian company, how do I send an invoice to Luxembourg?

If you are a Belgian company doing business with a Luxembourg company, you have to invoice according to Belgian rules. In Belgium, the Peppol network is the standard.

To send e-invoices, you must register through a certified Peppol Access Point such as Nymus. Both sole proprietors, and multinationals can use the Peppol network. The choice of a Peppol Access Point is not trivial and depends heavily on your business needs. Do you opt for a Peppol button in your ERP or billing package, or do you opt for an e-service provider that completely unburdens you?

Why choose Peppol with Nymus?

When you choose Peppol with Nymus, we completely unburden you. We are not a standard Peppol Access Point but a total solution for your billing process. Our goal is to seamlessly integrate Peppol into your entire process.

Our clients don’t have to lie awake about their billing process because we have all the knowledge and resources to do it for you. These are the factors that set us apart from other solutions.

- We'll make sure you comply with all the rules without a lot of internal changes.

- We think with you to provide a solution to your current problems.

- We completely unburden you. You don't have to lie awake worrying about all the changes in technology, legislation and tax or financial obligations.

- Thanks to our innovative mindset, we are keeping up with AI and blockchain developments. As a result, our technology is on point.

- At Nymus, a personal approach is key. We can be reached quickly, are short on time and know our clients' organization.

Nymus is ready for you

Still have questions or need help? No worries, we have a strong support team. We will guide you through the transition and help where needed.

Doing business in Luxembourg? Contact us!

Send Peppol invoices to Luxembourg flawlessly and efficiently? Contact us without obligation.