In this digital age, sending an invoice via email with an attached PDF file may seem like a quick fix. But did you know that this often does not meet the legal requirements for digital invoicing? Let’s take a closer look at why an email with PDF often does not meet the legislation and why an e-invoice is a much better option.

What is an e-invoice or e-invoice?

An e-invoice is a structured electronic file in an XML(Extensible Markup Language) format. This file follows a universal structure, the UBL or Universal Business Language, which allows all e-invoices to be processed fully automatically in software packages.

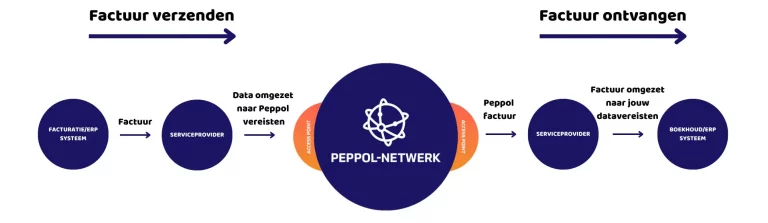

Sending these XML or UBL files is ideally done through the Peppol network, which is highly secure. In short, an invoice is not an e-invoice until the processing is fully automated.

An e-mail with PDF falls under the heading of digital invoicing. The difference with e-invoicing is that digital invoicing is not fully automated.

Read more: what is the difference between digital invoicing and e-invoicing?

Why does a PDF often fail to comply?

One of the most important aspects of an invoice is its authenticity and integrity. With a PDF e-mail, it is difficult to verify and guarantee the authenticity of the sender.

For example, how do you know who is behind the email address ikeetgraagchoco@gmail.com? And how do you prove that the content of the PDF file was not changed after it was sent? This can lead to legal complications and problems in proving the validity of the invoice.

The only way to send a legal email with PDF is if it is digitally signed and sealed. We know from experience that this is usually not the case.

With an e-invoice or e-invoice, the authenticity and integrity of the invoice is proven. The e-invoice is sent via a secure network, in Belgium the Peppol network.

To gain access to that network, the recipient must authenticate and therefore the recipient’s authenticity is confirmed. If the content of the e-invoice has been changed after sending, this is always visible. This lets you know that the integrity has been compromised and you can take action.

An email containing PDF is not secure

Another important aspect of digital billing is data security. When using an e-mail with a PDF attachment, the data may not be adequately protected.

For example, QR codes, which are often used to quickly access billing information, can be easily altered or manipulated when sent as part of a PDF file via e-mail.

This can lead to risks such as identity theft, fraud and unauthorized access to sensitive financial data. As a sender, if you don’t digitally sign and seal your invoice, you are personally liable. That can easily cost you thousands of dollars.

In contrast, e-invoices or e-invoices often feature advanced security measures, such as digital signatures and encryption.

They are sent over the secure Peppol network, where hackers cannot intercept them. This ensures the integrity and confidentiality of the data. This increases not only the security of the invoice, but also the trust of all parties involved in the billing process.

The benefits of an e-invoice

Many people think that sending an invoice via e-mail is free. However, when we consider the processing of that invoice, we see that an e-mail is more expensive than an e-invoice.

With an e-mail, you have to use recognition software and check, confirm or complete the data yourself. This means a lot of work and time is still wasted on this, and time is money.

Moreover, it is both more expensive for the sender, as well as for the recipient of the invoice. Often emails are still printed, further increasing costs. Looking at the overall picture, an e-invoice is the cheapest way to send an invoice.

As of Jan. 1, 2026, an email containing PDF is not legal

What is certain is that sending invoices via e-mail will soon be prohibited. Minister Van Peteghem recently made e-invoicing mandatory in the B2B sector as of Jan. 1, 2026. This obligation stems primarily from the need to combat VAT fraud.

Sending invoices to the government has already been mandatory since March 1, 2024. Therefore, we advise companies not to delay the switch to e-invoicing.

If everyone switches at the same time, the implementation time of electronic invoicing will be much higher. That could mean you won’t be ready in time for the new legislation and companies may refuse to pay your invoice.

Conclusion

While sending an invoice via email with PDF may seem quick and easy, it does not always meet legal requirements and can lead to issues of authenticity, integrity and efficiency.

For companies that want to comply with modern invoicing laws and strive for automation and efficiency, using e-invoices is the best solution. In addition to the benefits of e-invoicing, it will soon be mandatory. Therefore, we recommend that companies make the switch quickly.

Do you have questions about e-invoicing? Contact us and we’ll be happy to help. If Nymus is not the right solution for your needs, we will also tell you honestly.