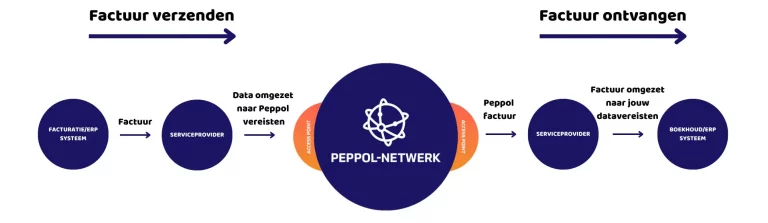

E-invoicing is booming. Within networks such as Peppol, electronic invoicing is not only faster and simpler, but from 2026 it will also become a legal requirement for B2B transactions in Belgium. Companies will be required to invoice each other via recognized networks such as Peppol. Paper or ordinary PDF invoices will then no longer suffice.

Yet we see in practice that many companies fall into the same traps. Small mistakes can have major consequences,rejected invoices, payment delays or even documents that never arrive. In this article you will discover which mistakes you should definitely avoid and how to set up a solid and future-proof e-invoicing flow.

Why e-invoicing is crucial to your invoicing process

E-invoicing through Peppol provides more transparency, faster payments and less manual work. But that’s only true if the process is set up correctly. A misaligned flow can lead to undelivered invoices, disputes that strain your cash flow and frustration among your customers as well as your finance teams.

The good news? Many problems are easy to avoid – as long as you pay attention to a few essential points of consideration.

The 5 biggest pitfalls in e-invoicing

1️⃣ Confusing a PDF with an e-invoice

An email with a PDF looks digital, but it is not an e-invoice. Only structured formats such as UBL or Peppol BIS meet the standard and can be processed automatically by accounting or ERP systems. A PDF requires manual processing – error-prone and inefficient.

2️⃣ Not checking whether the recipient is reachable on Peppol

An e-invoice via Peppol can only be delivered if the recipient is correctly registered on the network. Not all Access Points perform this check automatically. So always have an up-to-date Peppol address book or integrate automatic validation into your process to avoid “lost” invoices.

3️⃣ Poor data quality

An e-invoice is as smart as the data it contains. Errors in VAT numbers, IBANs or required fields such as order references lead to rejections or manual processing. Poor master data means higher error rates and more administration. Provide a central data source, validation rules and regular checks.

4️⃣ No consideration of foreign regulations

Do you work with foreign customers or governments? Then you need to consider local e-invoicing requirements that can vary greatly. In Italy, for example, there is a mandatory clearance model that requires invoices to first pass through a government platform. Inform yourself thoroughly and work with a solution that can handle this complexity.

5️⃣ No thorough testing or monitoring phase set up

An implementation is never “plug and play. Without a testing process, you miss crucial errors in the formatting, mapping or sending of e-invoices. Even after going live, monitoring is crucial: do invoices arrive effectively, are they accepted and are the data correct? By testing and monitoring, you avoid delays in payments.

Conclusion: e-invoicing pays off - provided you get it right

E-invoicing via Peppol offers great advantages: faster payment, less administration, higher accuracy and a stronger cash flow. But you only realize those benefits if you set up the process structurally and thoughtfully.

By investing smartly in the right tools, processes and partners, you turn e-invoicing into a strategic advantage rather than an operational challenge.

Ready to get e-invoicing really right?

At Nymus, we take care of the entire e-invoicing process. We make sure your company is correctly connected to Peppol, integrate IMRs effortlessly into your invoicing flow and connect everything flawlessly to your ERP or accounting system. After that, we continue to actively support and monitor your processes continuously, so you can count on a smooth and error-free invoicing process without any worries.

Want to be sure of an error-free e-invoicing process?

Contact us today for a no-obligation consultation.