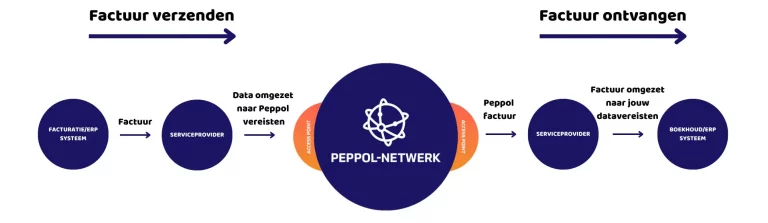

E-invoicing is much more than just a digital copy of a paper invoice. Certainly within Peppol, the international network for electronic document exchange, it is all about streamlined and controlled communication between companies.

An essential part of it? IMRs or in full: Invoice Message Responses.

In this blog, we explain exactly what IMRs are, why they are becoming increasingly important and how Nymus helps you stay compliant and efficient with them.

What can you read on this page?

What is an IMR?

An Invoice Message Response is a structured response message that the recipient of an electronic invoice sends back to the sender. Instead of just a silent receipt or a loose e-mail confirmation, IMR gives you a formal message within an e-invoicing flow.

For example, with an IMR, the recipient can indicate:

- That the invoice received has been received,

- That the invoice has been rejected (for example, due to an incorrect amount or a missing PO number),

- That the invoice has been accepted,

- or that the invoice is is ready for payment.

In a nutshell: IMRs make invoice communication more transparent, structured and fully automated.

Why are IMRs important?

In a traditional environment, think paper invoices or PDFs via email, structured feedback is lacking. You send an invoice and then the wait is in limbo: ” Has she arrived well? Is she being processed? Do you need to follow up?”

Often you don’t notice anything until a payment is outstanding or a customer reports a problem. That leads to delays, miscommunication and manual follow-up.

With IMRs, that changes fundamentally: you receive structured feedback on every step of the processing process, from receipt to approval or error.

The benefits of IMRs

IMRs are important because they provide faster and more transparent communication in the billing process. The benefits at a glance:

- Confirmation of receipt

You know immediately if an invoice has arrived correctly, eliminating uncertainty and unnecessary follow-up. - Fast error detection

If an invoice is rejected (e.g. due to a missing PO number), you get immediate feedback and can quickly correct it. This prevents long payment delays. - More efficient cash flow management

By understanding the status of your invoice faster, you can more accurately estimate when payments are coming in. - Automation and less manual work

IMRs are automatically processed in your ERP or accounting system – provided your software supports it and your e-invoicing provider has set up the link correctly. So you save considerably on manual follow-up.

In short, IMRs avoid miscommunication, speed up payments and make your billing process more efficient.

Checklist: what to look out for in IMRs?

✅ Use the same Peppol Access Point for sending and receiving

IMRs are always sent back to the Access Point your company uses to receive invoices. Are you sending through another Access Point? Then the reference to the original invoice is missing and the IMR message cannot be linked correctly.

✅ Check whether your customers are sending IMRs

Not all companies use IMRs by default. Coordinate this with your customers and their Access Point to avoid unexpected problems.

✅ Make sure your ERP, accounting system or e-invoicing provider can process IMRs

Receiving an IMR is not enough, you must also be able to interpret it correctly and process it within your system.

✅ Understand the different IMR states

A confirmation of receipt does not mean the invoice has already been paid. Make sure your team knows the difference between “received,” “processed,” “rejected” and “ready for payment.

✅ Test your process before going live

Run a test billing and verify that you receive the correct IMRs. This way you avoid surprises in your live process.

Specifically, what will change for businesses?

IMRs require companies to look at invoicing differently: no longer a one-way street, but an interactive process. Companies implementing e-invoicing through Peppol will increasingly find that customers or governments expect, or even demand, an IMR.

Meaning:

- Your e-invoicing provider or ERP system must be able to receive and process IMRs;

- Your internal processes must be set up to respond quickly to error messages or rejections.

Those who proactively pursue IMR integration now avoid problems and increase their efficiency.

How can Nymus help you do this?

Nymus offers scalable e-invoicing solutions that fully support IMRs within Peppol. Thanks to automatic interpretation, seamless interfacing with your ERP or accounting package and real-time monitoring of your invoice flow, we not only guarantee compliance. We also make sure you get paid faster and get a better grip on your cash flow.

Wondering what IMRs can do for your organization?

Contact us without obligation - we are happy to think with you.