A restaurant has a lot of dishes and uses a dishwasher to automate that process. Makes sense, doesn’t it? Just for the same reason, a business with a lot of outgoing invoices would benefit from automating the accounts receivable (AR) process. In this article, we explain what the AR process entails, what it looks like and what benefits it offers.

What is the accounts receivable process?

The accounts receivable process includes all the activities a company undertakes to receive payments from customers for goods or services provided. Although it seems simple at first glance, it is full of complexity and challenges.

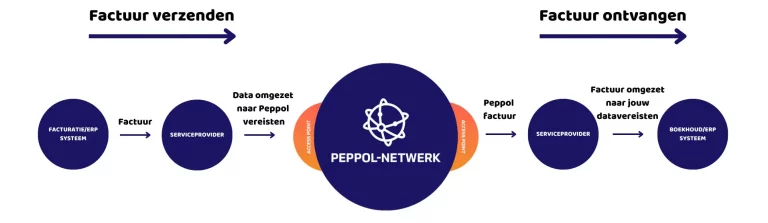

An efficient AR process is critical to a company’s healthy cash flow and financial stability. Challenges can range from different customer payment preferences, such as Peppol, PDF or mail, to time-consuming manual processes and regulatory compliance.

To address these challenges, using a software solution for the AR process can be very beneficial. This allows companies to focus on their core business while automating tedious tasks.

What steps does an AR software solution automate?

Let’s look at the steps in the AR process that can be automated:

1. Invoice creation

An AR software solution makes it easy to generate, personalize, authenticate, secure and identity-check invoices. All using uploaded data in various formats such as a PDF, XML or JSON.

Through the AR software solution, your invoice automatically complies with legislation. As a result, in case of phishing, you are not liable for damages.

2. E-archiving

Automatic archiving of invoices ensures that they are kept for at least 10 years and can be easily retrieved during audits.

3. Send invoice through all delivery channels

By automating your AR process, invoices can be sent through various delivery channels such as:

- Peppol

- Interoperability (Basware, Ariba, Tungsten)

- EDI

- Portal

- Email with PDF

- Post

One customer prefers a Peppol invoice, another customer prefers an email with PDF. Through AR automation, you choose your shipping method with one click.

Unique to this is the solution we offer: the Nymus portal. This allows both supplier and customer to have their own personalized portal for exchanging invoices. The advantage of such a portal is access to comprehensive overviews and reporting tools, while the customer can view and pay all their invoices from you in one central place.

4. Receiving feedback

With an automated AR process, companies save a significant amount of time. Thanks to real-time monitoring, you have constant insight into the status of your invoices. This includes various statuses, such as:

- Invoice sent

- Invoice delivered

- Invoice accepted or rejected

- Invoice paid

As a business, you don’t want to constantly check an invoice has been delivered or paid. In most cases, about 90%, the process goes off without a hitch and there is no need for manual intervention. With AR automation, you instantly identify which invoices are processed correctly, allowing you to focus on problem cases.

For example, if a company sends 100,000 invoices annually, this leads to huge time savings. Moreover, employees will be very grateful!

By having real-time visibility, you can identify problems faster, resulting in shorter invoice payment times.

5. Automatic payment

When the customer accepts the invoice, they can proceed to payment immediately. Through Nymus, we offer several payment options and various payment channels, including:

- The Nymus Portal

- A notification email with link or attachment

- Invoice in print/PDF with QR code

By automating this step in your AR process, customers can pay their invoices faster, increasing customer satisfaction.

6. Dunning

A dunning tool automatically sends reminders and reminders to customers whose invoices are past due, saving time and streamlining payment processes.

This means no more manual checking is needed to verify that an invoice has already been paid, which means you no longer waste time drafting emails or calling the customer.

Why should I automate my AR process?

Efficiency: AR software automates repetitive tasks such as authenticating, personalizing and securing invoices, as well as sending payment reminders

Accuracy: By replacing manual processes with automated workflows, AR automation reduces the risk of errors, such as losing track of outstanding payments or incorrect amounts.

Improved cash flow: On average, our customers get paid 8 days faster, significantly improving cash flow.

Better customer relations: By showing flexibility in how customers receive and pay invoices, you offer them an easier and more personalized payment experience. This leads to better customer relationships and satisfaction. A win-win.

So, just as a restaurant uses a dishwasher so they can focus on what really matters, AR automation allows businesses to focus on tasks that are really fun or important. Let’s face it, no one likes to wash dishes, and no one likes to perform tedious repetitive tasks.

Why choose Nymus as your AR solution?

When you choose AR automation with Nymus, we completely unburden you. For 12 years, we have been experts in optimizing the accounts receivable process. In those 12 years, we’ve never lost a client, and we’re very proud of that. Our clients don’t have to worry about their AR process because we have all the knowledge and resources to do it for you. These are the factors that set us apart from other solutions:

- We'll make sure you comply with all the rules without a lot of internal changes.

- We think with you to provide a solution to your current problems.

- We completely unburden you. You don't have to lie awake worrying about all the changes in technology, legislation and tax or financial obligations.

- Thanks to our innovative mindset, we are keeping up with AI and blockchain developments. As a result, our technology is on point.

- At Nymus, a personal approach is key. We can be reached quickly, are short on time and know our clients' organization.

Nymus is ready for you

Still have questions or need help? No worries, we have a strong support team. We will guide you through the transition and help where needed.

Request a free audit of your AR process!

Want to know what the opportunities are for your company? Then request your free audit with no obligation.