On Jan. 31, 2025, the Belgian federal government announced a new coalition agreement containing sweeping reforms in the areas of taxation and digitalization. One of the key points is the introduction of near real-time e-reporting for VAT transactions by 2028. This comes on top of the already announced mandatory e-invoicing for Belgian B2B transactions as of Jan. 1, 2026. But what does this mean concretely for companies?

What can you read on this page?

What you already knew: e-invoicing as of 2026

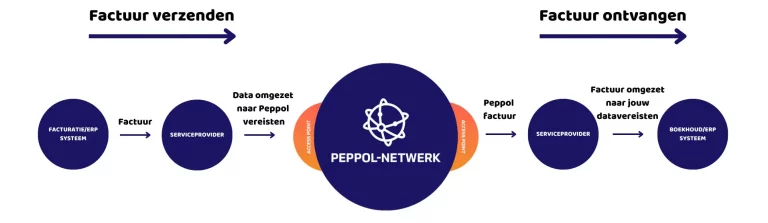

As previously announced, as of Jan. 1, 2026, the Belgian government requires structured electronic invoicing for almost all transactions between Belgian companies subject to VAT (B2B). This means that paper and PDF invoices will no longer suffice for these transactions. The aim of this measure is to automate VAT processing and further reduce the administrative burden for companies.

Important to know:

- The obligation does not apply to deliveries to individuals (B2C).

- Invoices must be sent and received in a structured electronic format.

- This will reduce invoice processing time and reduce errors.

Near real-time e-reporting by 2028

In addition to the e-invoicing requirement, there will be a near real-time e-reporting system in 2028. This means VAT data will be sent automatically and near real-time to tax authorities through integrated POS systems, payment systems and invoicing software.

Why this change?

- Reduced administrative burden: Automatic VAT returns make the work of finance departments more efficient.

- Anti-fraud: Real-time data makes it harder to avoid VAT.

- Better control: The government gains faster and more accurate insight into VAT transactions.

What does this mean for businesses?

Companies will need to change their billing and accounting processes to remain compliant. This includes:

- Invest in software compatible with e-invoicing and e-reporting.

- Verify that their current ERP and billing systems are ready for these changes.

- Develop a strategy for a smooth transition to the new VAT reporting system.

Time to take action

2026 and 2028 may still seem far away, but companies that prepare in time will benefit from a smooth transition and potential cost savings. Digitization is no longer an option, but a necessity.

Want to learn more about how to future-proof your invoicing and reporting systems? Contact a specialist in e-invoicing and e-reporting and make sure your business is ready for the future!

Want to know more about e-reporting?

Make sure your business is prepared for the new VAT reporting requirements. Find out how to optimize your systems for near real-time e-reporting and e-invoicing.