- Laatste update: 17/10/2024

The legislation regarding e-invoicing in Spain will become more concrete in the coming months. It is already mandatory for Spanish companies to send e-invoices to government agencies. Soon, e-invoices will also become mandatory for trade between Spanish companies.

Find out below the current legislation and what options Spanish companies have to exchange e-invoices.

B2G e-invoicing in Spain

Mandatory since 2015: all suppliers to the Spanish government must submit their invoices (above 5,000 euros) electronically through the central platform FACe, in the FacturaE file format, an XML-based standard. Invoices must be signed digitally.

Autonomous regions: although FACe is mandatory for the central government, regional administrations have autonomy. Most regions use FACe, except the Basque Country, which has implemented its own system called Ticket BAI. This system differs in terms of implementation timeline and requirements by province within the Basque Country.

B2B e-invoicing in Spain

Not yet mandatory: Currently, B2B e-invoicing is optional in Spain, but companies are already allowed to use the central platform FACeB2B. This platform was introduced in 2018 for subcontractors of public suppliers, and uses the FacturaE format.

Expected mandate in 2026: The “Crea y Crece” law of 2022 introduces a phase-in of mandatory B2B e-invoicing, with large companies required to comply first. This mandate is currently delayed and is not expected to take effect until 2026. Companies can continue to send invoices via paper invoices, PDFs with e-signatures, or EDI (Electronic Data Interchange) until the introduction of the mandate.

- First, companies with revenues over €8 million must comply with e-invoicing requirements.

- A year later, all other businesses and independents will follow.

E-reporting and Veri*Factu (anti-fraud legislation)

E-reporting: In addition to the e-invoicing requirement, an e-reporting mandate will also be introduced. Invoice data must be sent to the Spanish tax authorities through certified platforms.

Veri*Factu legislation: This law, designed to combat VAT fraud, requires companies to use certified invoicing software that sends invoices to the tax authorities in real time. The requirements of this law were to take effect July 1, 2025, but is being delayed to 2026 due to delays by the Spanish government.

Regional differences

Basque Country: The Basque Country region uses the Ticket BAI system for both B2G and B2B invoicing. This system requires invoices to have a unique XML file name and be digitally signed. Each province within the Basque Country (Álava, Gipuzkoa, Bizkaia) has different implementation timelines for this requirement.

As a Belgian company, how do I send an invoice to Spain?

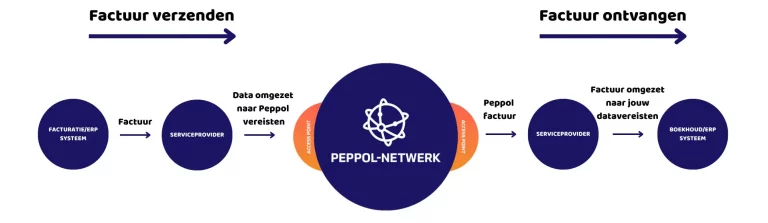

If you are a Belgian company doing business with a Spanish company, you must invoice according to Belgian rules. In Belgium, the Peppol network is the standard.

To send e-invoices, you must register through a certified Peppol Access Point such as Nymus. Both sole proprietors, and multinationals can use the Peppol network. The choice of a Peppol Access Point is not trivial and depends heavily on your business needs. Do you opt for a Peppol button in your ERP or billing package, or do you opt for an e-service provider that completely unburdens you?

Why choose Peppol with Nymus?

When you choose Peppol with Nymus, we completely unburden you. We are not a standard Peppol Access Point but a total solution for your billing process. Our goal is to seamlessly integrate Peppol into your entire process.

Our clients don’t have to lie awake about their billing process because we have all the knowledge and resources to do it for you. These are the factors that set us apart from other solutions.

- We'll make sure you comply with all the rules without a lot of internal changes.

- We think with you to provide a solution to your current problems.

- We completely unburden you. You don't have to lie awake worrying about all the changes in technology, legislation and tax or financial obligations.

- Thanks to our innovative mindset, we are keeping up with AI and blockchain developments. As a result, our technology is on point.

- At Nymus, a personal approach is key. We can be reached quickly, are short on time and know our clients' organization.

Nymus is ready for you

Still have questions or need help? No worries, we have a strong support team. We will guide you through the transition and help where needed.

Doing business in Spain? Contact us!

Send Peppol invoices to Spain flawlessly and efficiently? Contact us without obligation.