- Laatste update: 17/10/2025

Legislation around e-invoicing in France has changed significantly in recent years. French companies must already send electronic invoices to government agencies (B2G). From 2026-2027, e-invoicing will also become mandatory for trade between French companies (B2B) and reporting B2C transactions via e-reporting.

Discover below the current legislation and what options French companies have to exchange e-invoices.

What can you read on this page?

B2G e-invoicing in France

Mandatory since 2020: Since Jan. 1, 2020, companies doing business with the French government must submit electronic invoices through the central platform Chorus Pro.

Formats: Invoices must be submitted in UBL 2.1 or CII format, or in the hybrid Invoice-X format (a PDF with embedded XML data).

Future update: The new Portail Public de Facturation (PPF) platform is being rolled out. The PPF performs multiple functions: it acts as a directory of all businesses and government agencies, collects tax data, and provides central access for e-invoicing management. However, the platform does not yet completely replace Chorus Pro for B2G transactions.

French Annuaire: Operational within the PPF is the Annuaire, a registry that indicates the corresponding Accredited Platform (PA) for each recipient. This is crucial for the correct routing of invoices: your invoice will be sent to the recipient via the correct PA. The Annuaire is publicly accessible and is constantly updated with new registrations of companies and PAs, so you always know which platform your invoices should go through.(Annuaire Chorus Pro)

B2B e-invoicing in France

New legislation 2026-2027: From 2026, French companies will be required to send and receive electronic invoices through certified service providers called Plateformes Agréées (PA), formerly known as PDPs (Partner Dematerialization Platforms).

What is a PA?

A PA is a certified platform approved by the French government to process electronic invoices and automatically transmit tax data to the French tax authorities. The platform replaces the role of the old PDPs: all B2B e-invoices must go through a PA from implementation. This means that companies can no longer invoice directly through their own systems without a certified service provider, except during the transition period.

Phasing of commitment:

Sept. 1, 2026 – First phase:

- Required for large companies (turnover > €50 million and/or > 250 employees).

- These companies must send and receive both outgoing and incoming e-invoices through a PA.

- International B2B transactions must also be reported to the tax authorities via e-reporting.

- All companies doing business with these large corporations must have their systems ready to accept received e-invoices via a PA

Sept. 1, 2027 – Second phase:

- Mandatory for all other businesses, regardless of turnover or size.

- The obligation applies to all B2B transactions within France and to e-reporting of international transactions.

- From this point on, the use of a PA will be completely mandatory for everyone; the old PDP structure will no longer exist.

Formats and standards:

- Invoices must comply with the EN 16931 standard.

- Supported formats: UBL 2.1, UN/CEFACT CII, Invoice-X.

- E-invoicing via the Peppol network is also permitted and fully compatible with French legislation.

E-reporting

In parallel with e-invoicing, France has a requirement for e-reporting, the digital reporting of billing data to the tax authorities. This requirement is intended to simplify VAT administration and prevent fraud.

E-reporting is mandatory for transactions not within the national e-invoicing network, such as:

- International B2B transactions (with foreign companies),

- B2C transactions (sales to individuals),

- and certain VAT-related transactions for which no invoice is issued.

Reporting is done automatically through the company’s Plateforme Agréée (PA). This certified service provider collects the necessary data from the invoices and forwards them to the French tax authorities (DGFiP) according to the established format and rhythm.

Depending on the type of activity, reporting can be real-time, daily or monthly. Companies that do not use PA can use the Portail Public de Facturation (PPF) as an alternative to manually transmit their data.

This dual obligation – e-invoicing and e-reporting – gives the French government a complete and up-to-date picture of all domestic as well as cross-border transactions.

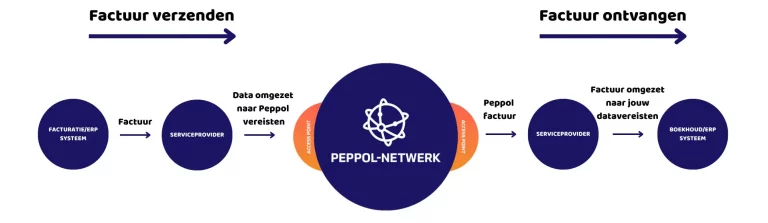

PAs and Peppol

Certified Platforms (PA): Companies are required to use a certified PA for their e-invoicing. These platforms process invoices and report tax data directly to the French tax authorities.

Peppol network: All PAs are connected through Peppol, allowing e-invoices to be exchanged globally.

Final certification: PAs are currently provisionally certified; final certification will follow interoperability testing and annual audits.

Impact for businesses

The introduction of e-invoicing and e-reporting in France is having a clear impact on businesses. Whereas the Portail Public de Facturation (PPF) used to serve as a free platform for submitting invoices, that role is limited today. The PPF now acts primarily as a central directory (Annuaire) and a data collection point for the French tax authorities.

Companies must now use a Plateforme Agréée (PA, ex-PDP) for sending, receiving and reporting e-invoices. These certified service providers offer commercial solutions, leaving no free option.

Sanctions for non-compliance

The French government has recently increased and expanded fines to enforce compliance.

For businesses:

- Failure to send an e-invoice: €50 per missing invoice, with a maximum of €15,000 per year.

- Failure to send an e-report: €500 per missing report, with a maximum of €15,000 per year.

- Failure to designate a Plateforme Agréée (PA): €500 fine after three months from first warning, then €1,000 for each additional three months of noncompliance.

- Late or incomplete reporting may also result in additional penalties, depending on severity and frequency.

For Plateformes Agréées (PAs):

- Fines of up to €100,000 for errors or non-compliant data transmissions.

- Annual technical audits are mandatory; non-compliance may result in temporary or permanent withdrawal of accreditation.

The government is providing a short transition period at the start of the obligation. During this “soft launch” phase, the emphasis is on guidance and warnings, but repeated or intentional violations will be fined. Companies would therefore be well advised to select their PA and align their processes with the PPF in a timely manner.

As a Belgian company, how do I send an invoice to France?

If you are a Belgian company doing business with a French company, you must invoice according to Belgian rules. In Belgium, the Peppol network is the standard.

To send e-invoices, you must register through a certified Peppol Access Point such as Nymus. Both sole proprietors, and multinationals can use the Peppol network. The choice of a Peppol Access Point is not trivial and depends heavily on your business needs. Do you opt for a Peppol button in your ERP or billing package, or do you opt for an e-service provider that completely unburdens you?

Why choose Peppol with Nymus?

When you choose Peppol with Nymus, we completely unburden you. We are not a standard Peppol Access Point but a total solution for your billing process. Our goal is to seamlessly integrate Peppol into your entire process.

Our clients don’t have to lie awake about their billing process because we have all the knowledge and resources to do it for you. These are the factors that set us apart from other solutions.

- We'll make sure you comply with all the rules without a lot of internal changes.

- We think with you to provide a solution to your current problems.

- We completely unburden you. You don't have to lie awake worrying about all the changes in technology, legislation and tax or financial obligations.

- Thanks to our innovative mindset, we are keeping up with AI and blockchain developments. As a result, our technology is on point.

- At Nymus, a personal approach is key. We can be reached quickly, are short on time and know our clients' organization.

Nymus is ready for you

Still have questions or need help? No worries, we have a strong support team. We will guide you through the transition and help where needed.