- Laatste update: 10/01/2025

The legislation regarding e-invoicing in Germany has changed significantly in recent years. All German companies must be able to receive e-invoices. The rules for trading with German government agencies are a bit more complicated.

Discover all info on e-invoicing in Germany here.

E-invoicing for German companies (B2B)

How is e-invoicing rolling out in Germany?

- From Jan. 1, 2025, all companies in Germany must be able to receive electronic invoices that comply with the EN 16931 standard.

- Sending e-invoices becomes mandatory in phases:

- Jan. 1, 2027: Large and medium-sized German companies (with a turnover of more than €800,000) must send e-invoices.

- Jan. 1, 2028: All German companies must send e-invoices.

Networks and formats

- Companies can choose ZUGFeRD, XRechnung, or Peppol BIS 3.0, all of which comply with the EN 16931 standard.

- Other EDI formats can also be used, as long as the invoice information can later be extracted according to the EN 16931 standard.

- Most importantly, the invoice content must comply with European standard EN 16931, which regulates the structure of the invoice.

What is ZUGFeRD?

What is it? ZUGFeRD is a hybrid format that contains both a PDF and an XML file. The PDF is readable by humans, while the XML contains structured data that can be processed by computers.

When to use? ZUGFeRD is often used for B2B transactions, especially when the invoice needs to be both human-readable and machine-readable. It is a good choice for companies that want to combine both manual and automated processes.

Use in Germany: ZUGFeRD is widely used for invoicing between companies in Germany because it is compatible with national standards and also supports the EN 16931 standard.

What is XRechnung?

What is it? XRechnung is an XML-based format developed specifically for electronic invoicing to the German government. It is fully structured and contains all the mandatory data required by the German government.

When to use? XRechnung is recommended for all invoices sent to the German government. Thus, it is the right choice for B2G (Business to Government) transactions.

Use in Germany: XRechnung has been the standard format for invoicing to the German government since November 2020 and is also increasingly used in the private sector, especially when companies do business with the government.

What is Peppol BIS 3.0?

What is it? Peppol BIS 3.0 is an open standard based on the UBL (Universal Business Language) and CII (Cross Industry Invoice) XML formats. It is a standardized format supported by many European countries and can be sent through the Peppol network.

When to use? Peppol BIS 3.0 is suitable for companies doing international business, especially if they want to use the Peppol network for secure and standardized billing.

Use in Germany: Peppol BIS 3.0 is one of the formats accepted by the German government for B2G transactions, and it is also increasingly used in B2B transactions, especially for international trade.

When do you choose which format?

- XRechnung: Recommended for B2G in Germany, can also be used for B2B.

- ZUGFeRD: Suitable for B2B in Germany, especially if a hybrid solution is desired.

- Peppol BIS 3.0: Suitable for both B2B and B2G, especially for international transactions and companies using the Peppol network.

E-invoicing for the German government (B2G)

Sending electronic invoices to government agencies (B2G e-invoicing) in Germany is complex because the rules vary from state to state. Here is an overview of what you need to know.

Obligations:

- Since November 2020, it has been mandatory for all German government agencies to accept electronic invoices. This applies to federal, state and local governments.

- Several formats are allowed, such as XRechnung, ZUGFeRD, and Peppol. These formats are all compliant with European standard EN 16931.

- Depending on the government unit, it may even be mandatory to send electronic invoices.

Overview of commitments by level:

- Federal governments:

- Required to accept e-invoices through specific portals (e.g., ZRE for federal administrations with a Leitweg ID beginning with 991).

- States:

- All German states must be able to receive electronic invoices. The obligations vary by state:

- Obligation: In the federal states of Bremen, Baden-Württemberg, Hamburg, Hesse, Mecklenburg-Vorpommern and Saarland, sending e-invoices is already mandatory.

- Upcoming obligations: In Rheinland-Pfalz, e-invoicing will become mandatory from April 1, 2025.

- Optional: In the other states, sending e-invoices is currently possible but not mandatory.

- Local administrations (municipalities) can also accept e-invoices, but this is often optional.

- All German states must be able to receive electronic invoices. The obligations vary by state:

What is a Leitweg ID?

Every invoice to a government agency must contain a Leitweg ID, which is used to send the invoice to the correct agency. This is a unique identifier for the receiving agency.

Archiving

All e-invoices must be archived for 10 years.

Through which network?

In Germany, there are several options for sending e-invoices. The permitted platforms are XRechnung, ZUGFeRD or Peppol.

All B2G invoices must contain a Leitweg ID. This is an official identification number for German government agencies.

As a Belgian company, how do I send an invoice to Germany?

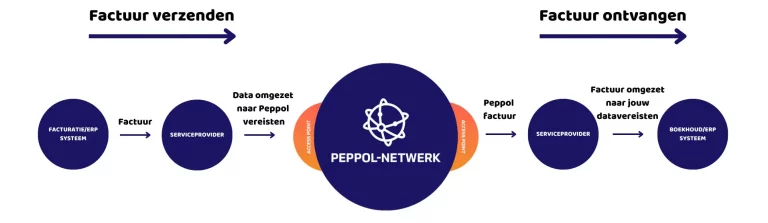

If you are a Belgian company doing business with a German company, you have to invoice according to Belgian rules. In Belgium, the Peppol network is the standard.

To send e-invoices, you must register through a certified Peppol Access Point such as Nymus. Both sole proprietors, and multinationals can use the Peppol network. The choice of a Peppol Access Point is not trivial and depends heavily on your business needs. Do you opt for a Peppol button in your ERP or billing package, or do you opt for an e-service provider that completely unburdens you?

Why choose Peppol with Nymus?

When you choose Peppol with Nymus, we completely unburden you. We are not a standard Peppol Access Point but a total solution for your billing process. Our goal is to seamlessly integrate Peppol into your entire process.

Our clients don’t have to lie awake about their billing process because we have all the knowledge and resources to do it for you. These are the factors that set us apart from other solutions.

- We'll make sure you comply with all the rules without a lot of internal changes.

- We think with you to provide a solution to your current problems.

- We completely unburden you. You don't have to lie awake worrying about all the changes in technology, legislation and tax or financial obligations.

- Thanks to our innovative mindset, we are keeping up with AI and blockchain developments. As a result, our technology is on point.

- At Nymus, a personal approach is key. We can be reached quickly, are short on time and know our clients' organization.

Nymus is ready for you

Still have questions or need help? No worries, we have a strong support team. We will guide you through the transition and help where needed.

Send Peppol invoices to Germany flawlessly and efficiently? Contact us without obligation.

HIGHLIGHTED ARTICLES