More and more companies are turning to e-invoicing via Peppol. Especially now that e-invoicing will become mandatory for B2B transactions in many more European countries, it is essential to have your processes in order.

Those who want to take the optimal approach link their ERP system directly to Peppol. This creates an automated, transparent billing flow without manual errors.

In this blog, we explain step by step how to link your ERP to Peppol, what to watch out for and what pitfalls to avoid.

What can you read on this page?

What exactly is Peppol?

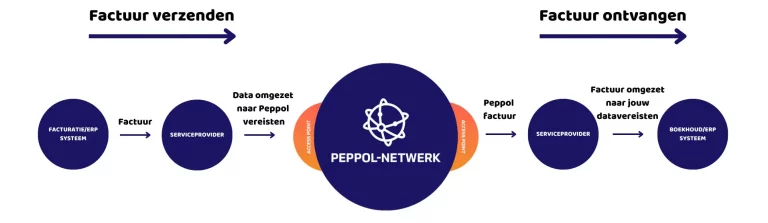

Peppol (Pan-European Public Procurement Online) is a standardized and secure network that allows companies and governments to exchange electronic documents – such as invoices, purchase orders and credit notes – efficiently and in a structured manner.

Peppol provides a uniform way to send and receive invoice data. Some service providers or ERP systems allow Peppol invoices to enter the recipient’s system automatically and directly, without manual intermediate steps or e-mail attachments.

For businesses, that means:

- Less manual handling

- Fewer issues

- Faster processing and payment

- Improved follow-up via status messages (IMRs).

Starting in 2026, Peppol (or a similar network) will become mandatory for B2B e-invoicing in many European countries, including Belgium.

Why link your ERP system to Peppol?

Your ERP system (such as SAP, Microsoft Dynamics, Exact or Odoo) is the heart of your business administration: from ordering to delivery and invoicing.

By linking this system directly to Peppol, you put your billing process on autopilot. What does that deliver?

1. Fully automatic processing

Invoices are sent and received directly from or to your ERP, with no manual intermediate steps.

✔ No copying/pasting of data.

✔ No risk of errors due to manual input

✔ No duplicate processing

2. Faster processing of incoming and outgoing invoices.

Invoices via Peppol arrive faster and are processed immediately. You avoid delays caused by emails or scans.

3. Fewer errors, more control

Structured formats such as UBL allow invoices to be automatically matched with orders or receipts in your ERP.

✔ Fewer errors during approval or payment

Better follow-up and reporting.

4. Time savings for the finance team

Manual tasks disappear. Your team gains room for follow-up, monitoring and strategic analysis.

5. Getting paid faster

Because invoices come in correctly, completely and digitally, they can be approved faster, especially when combined with PO matching.

6. Ready for e-invoicing legislation

You automatically comply with European e-invoicing and e-reporting obligations, without having to make new ERP adjustments each time.

7. Stronger collaboration with suppliers and customers

Peppol is the standard with governments and large corporations. By being included, you show that you are professional, efficient and digital.

How to link your ERP system to Peppol (roadmap).

1. Analyze your current situation

Good preparation begins with insight:

- Does your ERP support Peppol natively or via external linkage?

- What type of documents do you send (invoices, credit notes, purchase orders)?

- Are your master data (such as PO numbers, VAT data) complete and correct?

A clear analysis saves time and costs later.

2. Choose a reliable Peppol Access Point partner

Many ERP systems offer a basic connector or “standard Peppol connection.” Convenient, but not always sufficient. Especially in complex environments, it is smart to choose a specialized Access Point partner that:

- You seamlessly integrate e-invoicing into your existing processes

- Understand local legislation (as in Belgium and the Netherlands) in detail

- Automatically tracks and processes IMRs and updates

- Grow with your ERP and organization – from SAP to custom systems

At Nymus, we combine in-depth knowledge of the Benelux market with a technical solution tailored to your needs. So you can be sure of correct, secure and future-proof e-invoicing.

3. Arrange your data flows correctly

Are you working with a solution where you provide the UBL yourself? Then the onus is on you to make sure your e-invoice meets all Peppol specifications and your customer’s requirements. Meaning:

- Correctly completed fields (such as PO numbers and references)

- Invoices in Peppol-compliant format (such as BIS Billing 3.0)

- Validation and test flows to detect errors in advance

On the other hand, do you choose an e-invoicing partner like Nymus? Then we provide a one-time smart integration with your ERP or platform. Afterwards, we make sure that every invoice:

- Compatible with Peppol and the end customer

- Staying up to date with format changes (such as BIS 4.0)

- Correctly validated before shipment

This way you avoid errors, extra workload or delays and the final responsibility lies with your service provider.

4. Test thoroughly before going live

A detailed testing phase prevents many problems:

- Send test invoices to a sandbox environment.

- Simulate errors (e.g., missing fields) and check how your ERP and Access Point respond.

- Check that IMRs are correctly received and interpreted.

Why testing is important: 90% of errors are detected before they impact your operational operation.

5. Provide follow-up and continuous optimization

Going live successfully does not mean you can sit back:

- Peppol standards may evolve.

- New clients may have additional requirements (e.g., additional references).

- Updates in your ERP can affect Peppol integration.

A partner offering monitoring and support, such as Nymus, prevents problems before they escalate.

Common mistakes in ERP integrations with Peppol

🚫 Thinking that a PDF via email also suffices as “e-invoicing

🚫 Not sending PO numbers along, resulting in invoices being automatically rejected.

🚫 Ignoring or not automatically processing IMR messages.

🚫 Not sufficiently testing dataflows, resulting in massive error messages.

🚫 No clear internal procedures for following up on status updates.

Importance of compliance toward 2026

Starting in 2026, electronic invoicing will become mandatory for B2B transactions in many European countries, including Belgium. Paper invoices or regular email attachments will no longer suffice. A proper connection to Peppol through your ERP ensures that your company is fully compliant and prevents fines, delayed payments or operational chaos.

Conclusion: smart integration saves you time, money and headaches

By cleverly linking your ERP to Peppol:

- Speed up your billing process.

- Get real-time visibility into the status of your invoices.

- Lower your margin of error dramatically.

- Ensure compliance and strong cash flow.

Good preparation, the right partner and continuous optimization make the difference.

Ready to smoothly link your ERP system to Peppol?

At Nymus, we guide companies step by step to a future-proof e-invoicing process: from analysis and connection to testing, monitoring and continuous support.

Do you work with SAP or Microsoft Dynamics 365 Business Central? Good news:

Want to ensure flawless and compliant Peppol integration?

Contact us today for a no-obligation consultation.