In the dynamics of contemporary business, the invoice as a silent witness to financial transactions is indispensable. Let’s take a journey through time, from clay tablets of ancient Mesopotamia to the advanced digital revolution, and end with a look to the future.

The beginning of the invoice

The story of the bill begins in the ancient city of Uruk, a civilization that arose on the banks of the Euphrates River in southern Mesopotamia around 3000 bc (present-day Iraq).

Early forms of written communication arose from the practical need to keep records of both outgoing and incoming commercial transactions.

Cuneiform served as an early proof of transactions and originated in the administrative needs of Sumerian temple priests. These clerics introduced cuneiform to closely monitor agricultural products, with a specific emphasis on by-products such as bread and wine.

The symbols on the clay tablets contained rudimentary representations of the relevant goods that were recorded in the temple records. These clay tablets gradually evolved into detailed inventories, including price and quantity, and thus represented an early and rudimentary stage in the history of billing and administrative practices.

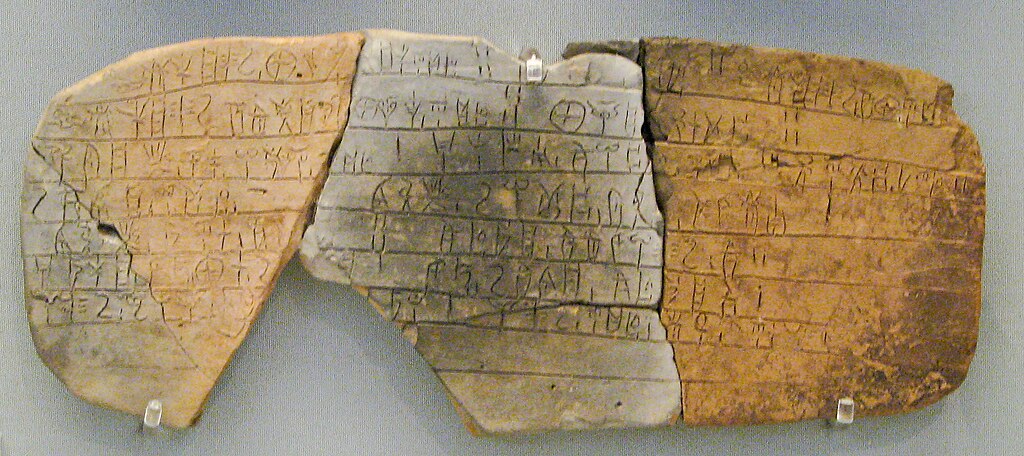

The Pylos tablets 1450 bc

An archaeological find in the ruins of Nestor’s palace in the ancient Mycenaean city of Pylos, one of the oldest surviving specimens of the first script in Europe, the Linear B script

This discovery has special value because the Pylos tablet attests to the use of an early form of accounting by the ancient Greeks.

The clay tablet includes a detailed list of trade items, similar to cuneiform invoices.

One of these – the Pylos Tablet Tn 996 – is believed to be a bill for bathtubs, water bottles, cups, drinking jars, jugs, gold vessels and an oil lamp.

What distinguishes the Pylos tablet is its uniqueness in that it also specifies the names of both sender and receiver. This specification indicates that the ancient Greeks were already using an advanced form of billing as part of trade and other exchange practices.

The presence of this information on the tablet provides insight into the advanced administrative and accounting methods used at the time, and highlights the early use of billing techniques in ancient Greek society.

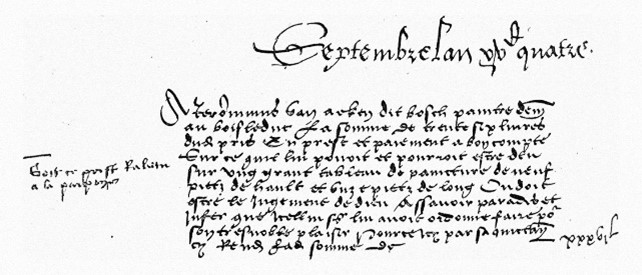

1604: first handwritten invoice

Hieronymus Bosch billed King Philip of Castile for “The Last Judgment,” which is considered the very first handwritten invoice.

In stark contrast to today’s standardized invoices, this invoice was more like an informal bill, on which calculations were scribbled in the margin. Bosch’s approach provides insight into the informal and personal nature of financial transactions at the time, as opposed to the formalized procedures we are used to today.

The use of invoices and written accounting developed throughout history in response to the growth of trade and commerce. The modern concept of billing is more a product of the industrial revolution and the rise of complex business transactions over the past few centuries.

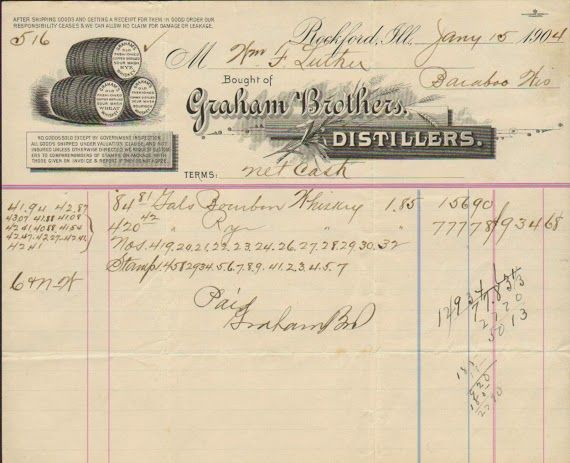

Early 20th century

Graham Brothers Distillers held a vanguard role in the implementation of technological innovations within the field of professional billing.

The 1904 invoice, prescient of its time, already integrated standard elements such as a printed logo, company address and phone number – elements that are taken for granted today.

This billing, which also acted as a marketing tool with a prominent letterhead, reflected early technological developments in billing.

However, one salient aspect of this early invoice was its manual nature. Recipients had to perform extensive division themselves to calculate the cost of specific items.

This highlighted both the progression in technological applications within billing practices and the still existing limitations in the automation of these processes at the time.

First computer generated invoice

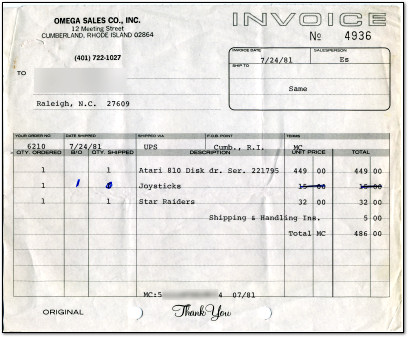

The late 20th century saw a significant transformation in billing methodology with the emergence of computerized systems. In the year 1981, Omega Sales Co. illustrated this transition by implementing a computer-generated invoice, signaling a shift from paper to digitally generated invoices in certain business sectors.

This event served as an early exponent of the integration of information technology into financial processes, with technological advances unlocking the potential to revolutionize traditional approaches to billing and create efficiencies.

In the 20th century, the use of paper invoices reached its peak. Companies faced the challenge of managing huge amounts of paperwork. It became clear that a turnaround was needed.

Paper overload and need for change

Although Electronic Data Interchange (EDI) has been around for many decades, it has not yet led to a completely paperless office.

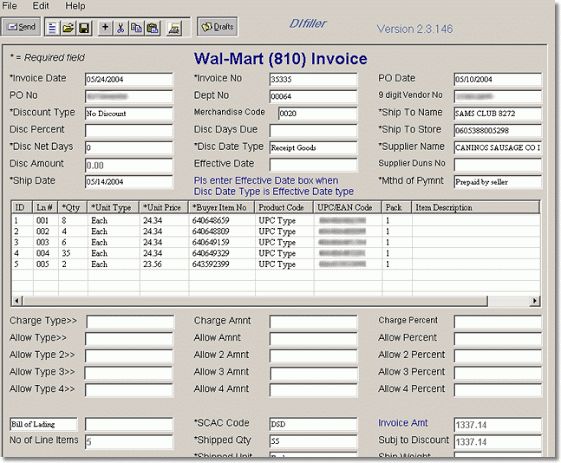

The pictured screenshot of a Walmart invoice highlights the ubiquitous visual features of ERP (enterprise resource planning) based solutions common to date.

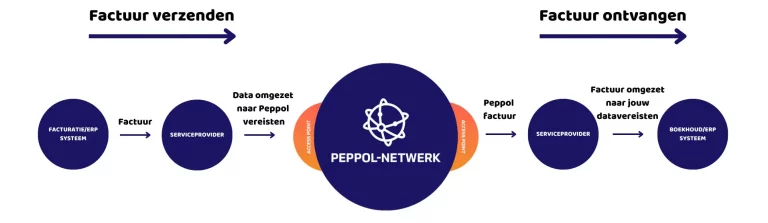

21st century: Nymus and the e-volution

In this digital age, Nymus is at the forefront of the digital revolution of invoicing. Electronic invoices not only reduce paper consumption, but also speed up transactions and improve the accuracy of financial data. Amid this shift toward digitization, Nymus is leading the way to a more efficient and faster future.

Looking back at the evolution of the invoice, we see a change not only in form, but also in the efficiency and speed of doing business. Nymus embodies this progress and demonstrates that the future of financial accounting is digital. In a world that is all about precision and speed, Nymus is the catalyst for a new standard in business.

Wondering how we can make sure your bill is with the times?