From Jan. 1, 2026, e-invoicing will become mandatory for companies in Belgium. This means that from that date you will have to send structured electronic invoices, making the invoicing process a lot more efficient. The government has taken this step to reduce VAT fraud and make the whole process simpler. For many companies, this means a change in the way invoices are exchanged. Wondering what exactly the law means and how to make the switch easy? Read on quickly!

What can you read on this page?

What is e-invoicing?

E-invoicing, or electronic invoicing, is the way to send and receive invoices smarter and faster. Forget paper invoices and unstructured emails: with standardized formats such as UBL (Universal Business Language), you exchange data securely and effortlessly between systems.

The European Union has taken a clear step into the future with the ViDA(VAT in the Digital Age) Directive. By 2030, e-invoicing will become mandatory in all member states. Why? To modernize and simplify VAT returns. This means less hassle, fewer errors and more time to focus on what really matters: growing your business.

Electronic invoices: fast, smart and error-free

Electronic invoices, or e-invoices, are much more than just a digital version of paper invoices. They are structured data files, such as UBL, that allow invoices to be processed automatically. This makes the invoicing process not only faster, but also much more accurate.

By switching to e-invoicing, companies can simplify their administrative processes, resulting in less manual entry and therefore less chance of errors. The automated system ensures that your invoices are processed and verified correctly in no time. This means less hassle with paperwork and more efficiency in your daily operations. And with the future requirement of e-invoicing in the EU, now is the perfect time to get your business ready for the future.

Why is electronic billing becoming mandatory?

The Belgian government estimates that some 11 billion euros of VAT revenue is lost annually due to VAT fraud. This makes Belgium one of the worst students in the class. Not surprisingly, the government has looked for a solution: e-invoicing, or electronic invoicing.

With growing obligations for companies and governments to implement e-invoicing, the pressure is mounting. As of 2026, all taxable companies in Belgium are required to send and receive B2B invoices electronically. Since March 2024, this has already applied to invoices to government agencies. In this case, an e-invoice is sent as a UBL file via a secure network.

“Another new law for businesses,” I might hear you thinking. True, but this law also offers many advantages if done right. It makes the exchange of invoices between companies standardized, automated and, above all, more secure. Electronic invoicing not only saves companies time, but also money, through the increased efficiency and cost savings it brings.

Who is required to use e-invoicing?

So from Jan. 1, 2026, the time has come: all Belgian companies liable for VAT must use e-invoicing for their outgoing invoices to other companies. This applies to all B2B transactions, but not to deliveries to individuals for private use(B2C). And yes, there are some exceptions for companies in certain sectors or who already use another system, such as EDI.

As a company, it is important to prepare well so that there are no surprises. By taking action now, you can make the transition to e-invoicing much easier and start reaping the benefits right away: less red tape, faster processing and less chance of errors. Make sure you are ready for the new rules so you can continue to invoice with peace of mind.

What should you do as a Belgian company liable for VAT?

Step 1: Join the Peppol network

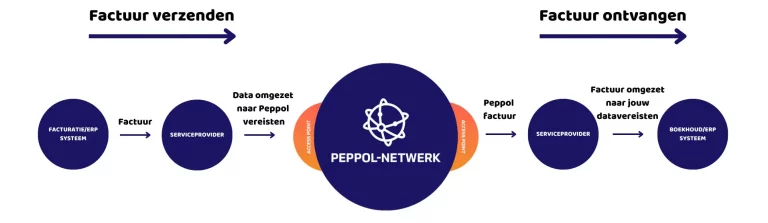

As of 2026, you must have access to the Peppol network to comply with Belgian legislation. Peppol (Pan-European Public Procurement OnLine) is a secure, international network that allows you to exchange electronic documents such as invoices. The federal government is playing an important role in the rollout of this network.

To use the Peppol network, you need a Peppol Access Point needed. There are already many Access Points out there, so it’s smart to research carefully which solution is the best fit for your business. Consider things like support, reliability and integration capabilities.

Step 2: Create invoices in UBL format

Through the Peppol network, invoices are sent in the UBL (Universal Business Language) format. This format ensures that data is exchanged between systems in a standardized and structured way. It is as if all your invoices speak the same language, so computers can easily understand them.

To convert your invoices to UBL, you can use an e-service provider or an ERP system. If you have a technically strong IT team, they may also be able to build this themselves.

So what is the difference between XML and UBL? Think of it this way: XML is the alphabet and UBL is the language that uses that alphabet. XML provides the basic structure, while UBL provides the specific rules for creating an e-invoice.

Belgium has created its own UBL standard so that everyone works the same way. This makes it easier to automate and standardize your invoicing process.

Why switch now?

We get it: change can be tricky. But trust us, you’re going to be happy to be rid of emails with PDF attachments. Electronic invoicing via UBL is faster, more secure and reduces errors. Plus, there are tax measures that support companies in making the technical adjustments.

In short: start on time, choose the right tools and get ready to work more efficiently!

How does Nymus help you?

When you choose to switch to e-invoicing with Nymus, we completely unburden you. We’re not just another Peppol Access Point, we go that extra mile.

Our team developed a proprietary platform where we process and send the invoice (via letter, email, EDI and Peppol). 100% legally valid and in the desired format. Integratable on all accounting systems and ERP packages, both national and international. All we need from you is a UBL/XML file or PDF format.

With Nymus, you make your entire invoicing process faster and more efficient. On average, our clients get paid 8 days faster and save 20% time on administration.

What sets us apart from other solutions

For 12 years we have been experts in optimizing the billing process. In those 12 years, we’ve never lost a client, and we’re very proud of that. Our clients don’t have to lie awake about their billing process because we have all the knowledge and resources to do it for you. These are the factors that set us apart from other solutions:

- We make sure you comply with the new e-invoicing rules without many internal changes.

- We think with you to provide a solution to your current problems.

- We completely unburden you. You don't have to lie awake worrying about all the changes in technology, legislation and tax or financial obligations.

- Thanks to our innovative mindset, we are keeping up with AI and blockchain developments. As a result, our technology is on point.

- At Nymus, a personal approach is key. We can be reached quickly, are short on time and know our clients' organization.

Nymus is ready for you

Still have questions or need help? No worries, we have a strong support team. We will guide you through the transition and help where needed.

E-invoicing without problems?

Want to send e-invoices in 2026 without hassle and make the invoicing process easy? Simply request your API token and try Nymus for free for 30 days.